Trading commodity futures and options involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge and financial resources.

By: Ted Seifried, senior broker at Zaner Group.

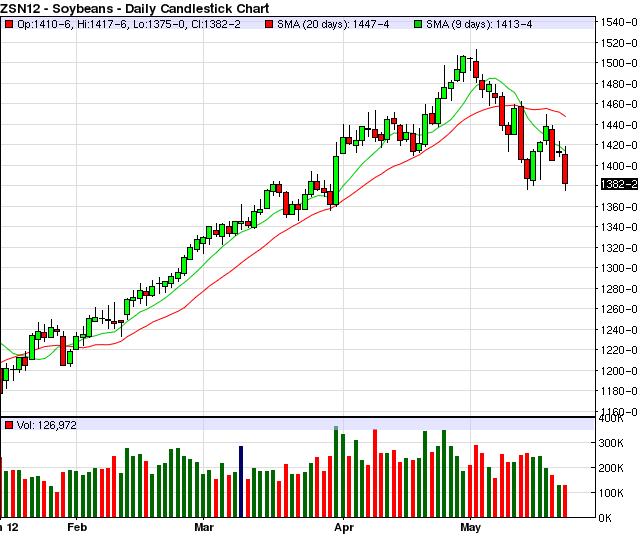

November Soybeans Struggle to Rally with Other Grains (written 5/17)

Old crop corn, old crop soybeans, and wheat all had a nice rally today. November soybeans however settled well of its highs. Here again, an ultra fast planting pace could be weighing on new crop pricing. Also, a little hotter dryer pattern may be affecting wheat and to a small extent corn but soybeans should fair well.

Soybeans have worked hard to buy acreage away from corn since the March 30th USDA planting projections report and, the fast planting pace has some experts thinking that we could see a jump double cropped soybean acreage. This could significantly loosen the tight ending stocks projections for next year.

See November Soybean Daily chart:

This means that speculators should be looking for opportunities and producers need to make sure they lock up prices that makes sense for their bottom line. Give me a call for some ideas. In particular, producers looking to hedge all or a portion of their production may be rather interested in some of the strategies that I am currently using.

In my mind there has to be a balance. Neither technical nor fundamental analysis alone is enough to be consistent.

Please give me a call for a trade recommendation, and we can put together a trade strategy tailored to your needs.

Ted Seifried (321) 277-0113 or tseifried@zaner.com

Call Ted Seifried at (312) 277-0113

or e-mail him at tseifried@zaner.com

How to open an account with Zaner Group.

Additional charts, studies, and commentary can be found at Markethead.com.

Subscribe FREE to Zaner Group’s Daily Research Newsletter.

View my thoughts on other markets at Ted Seifried Futures Trading Strategies blog.

Futures, options and forex trading is speculative in nature and involves substantial risk of loss. All known news and events have already been factored into the price of the underlying commodities discussed.

- Rick Alexander’s Grain futures commentary (5/18)

- Corn Catches a Nice Bounce Off of Lows (5/17)

- Judy Crawford’s Grain futures Market Update (5/16)

- Soybean Meal futures show a fresh buy signal (5/10)

- Pre USDA Report Thoughts (5/10)

- USDA Crop Report Quick View (5/10)

- Metal complex tumbles, Gold futures generate a sell signal (5/11)

- Rick Alexander’s Meat futures commentary (5/16)

- Judy Crawford’s Stock Index futures Market Update (5/16)

- Heating Oil & Gasoline RBOB show sell signals (5/14)

- Rick Alexander’s Financial futures commentary (5/16)

- Live Cattle & Feeder Cattle futures give buy signals (5/15)

- Judy Crawford’s Currency futures Market Update (5/16)

- Cotton #2 futures show a fresh sell signal (5/16)

- Rick Alexander’s Energy futures commentary (5/16)

- Feeder Cattle futures show a buy signal (5/17)

- Markethead: Quotes, charts, news, commentary and more

Soybean futures issue a sell signal (5/18)

Trading commodity futures and options involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge and financial resources.

By: Larry Baer, senior broker at Zaner Group.

Soybean futures declined today (5/18) following three previous trading sessions of gains.

This move lower for both July and November soybeans gives me sells signals on the daily chart. This is the first sell signal soybeans have issued since the trend changed to the downside. Soybeans also close below its 50-day SMA, a bearish indicator. The trend is down on the monthly chart for the November and July beans and so far this month they are showing a key reversal.

Although soybeans have not confirmed to me they are in a longer-term downtrend I look for prices to move lower in the short term.

Subscribe FREE to Larry Baer’s Daily Charts & Set-Ups Newsletter.

For additional customizable charts and quotes visit Markethead.com for a FREE, no-obligation 30 day subscription.

Call me for trade set-ups at (312) 277-0112

SEE CHART

Call me for details and trade set-ups at (312) 277-0112

or toll free at 888-281-4161

or email: Lbaer@Zaner.com

How to open an account with Zaner Group.

Open an account with Larry Baer at Zaner Group.

Subscribe FREE to Zaner Group’s Daily Research Newsletter.

View my thoughts on other markets at Larry Baer’s Options & Futures Trading Strategies.

Futures, options and forex trading is speculative in nature and involves substantial risk of loss. All known news and events have already been factored into the price of the underlying commodities discussed.